Below are six steps to ensure your first days in the UAE run easily. This account may be very practical for managing your investments remotely, while benefiting from the soundness open personal bank account in dubai of the native banking system. It Is the best account for residents, expatriates and buyers who wish to handle their private bills quickly and easily. Opening a checking account is important within the UAE, whether you’re a resident or an investor.

The Travel And Tour Business In The Uae

- And should you’re seeking to put cash into actual property or put together to arrange your own enterprise, it’s always simpler to maneuver forward with an skilled local associate.

- Focusing on innovation and experience, we are a dependable vacation spot for all of your company problems.

- Month-to-month financial institution statements offer insights into your financial habits, serving to you finances and plan for long-term objectives.

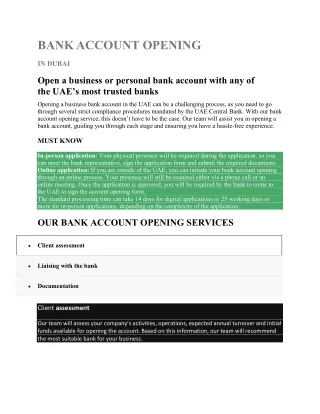

- You can open a private checking account in Dubai by visiting a department or by way of the bank’s on-line portal, which is a handy option provided by most UAE banks.

- Furthermore, banks present a diverse array of advantages with their debit and bank cards.

It helps to do your analysis beforehand so you already know what financial institution, or banks, you will go for once you arrive. Dubai confirms its status as the global https://execdubai.com/ capital of enterprise tourism in 2025, establishing itself as… The actual property market in the United Arab Emirates is present process a profound transformation. It is used to gather customer funds, pay suppliers and handle firm expenses.

You can open a personal checking account in Dubai by visiting a department or through the financial institution’s online portal, which is a convenient choice supplied by most UAE banks. By opening a private bank account in Dubai, you guarantee your funds are safe. Banks have robust safety measures and safeguards to protect deposits, minimizing risks like theft or loss. The UAE banking sector enforces strict documentation requirements to prevent fraud and guarantee monetary transparency. Below is a abstract of the important paperwork needed for both residents and non-residents.

For Digital Nomads:

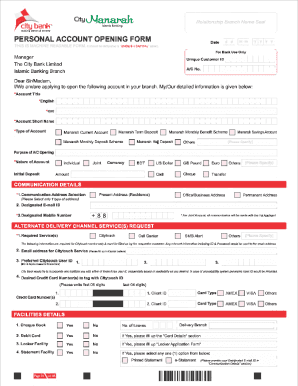

Opening a personal checking account within the UAE requires legitimate identification, a verified supply of income, and compliance with local financial regulations. Most banks within the UAE allow residents and non-residents to open accounts, but the documentation and approval timelines differ based on residency status. The essential course of includes selecting an appropriate financial institution, getting ready the required paperwork, and completing an in-person verification at the branch. Open a personal bank account in the https://bunnyflip.cl/enterprise-arrange-registration-companies-in-uae/ UAE for salary transfers, every day transactions, and savings. Our providers embody account opening for UAE residents and non-residents, with choices for basic savings accounts or premium account packages.

For Non-residents (offshore Accounts):

Here are the various sorts of bank account you can open in the UAE. Our website might list various banks for informational purposes solely, and such listings should not be construed as a direct tie-up or partnership with the mentioned banks. We aim to assist our purchasers in navigating the advanced landscape of banking products by offering our experience and guidance. With a financial savings account, you earn curiosity (or profit in Islamic banking). This serves as an extra supply of revenue and encourages regular saving habits.

It Is advisable to verify the precise requirements of the bank you choose, as they will range barely. A private checking account allows you to make payments with ease utilizing cheques, online transfers, or bank apps. Many UAE banks also present 24/7 online banking companies to make your life simpler. A personal bank account in Dubai is a vital software for everyday life, whether or not it’s for managing on-line funds or receiving your month-to-month wage.

You now know the general guidelines to follow, the variations between a private, firm or investor account, the steps to take relying on your status, and the banks most accessible to expatriates. You Will even have found some easy suggestions for avoiding refusals and speeding up the opening of your account. Lastly, it facilitates your real property or enterprise funding tasks, as many transactions require a neighborhood checking account. Furthermore, banks present a diverse array of benefits with their debit and bank cards registration of company in dubai.

Open specialized financial savings accounts or investment accounts with aggressive rates. Our checking account specialists allow you to examine account advantages throughout totally different UAE banks to find one of the best account in your monetary objectives. You can open a personal checking account in UAE as a non resident if you observe the proper process and put together paperwork properly. If you need assist with bank choice, compliance, and approvals, HVUAE can information you.