Forex Trading for Beginners: A Comprehensive Guide

Forex trading, also known as foreign exchange trading, is the process of exchanging one currency for another. With a daily trading volume exceeding $6 trillion, it stands as one of the most liquid markets in the world. For beginners looking to enter this exciting field, understanding the fundamental concepts and strategies is essential. In this guide, we will walk you through everything you need to know to get started with forex trading, including key terms, strategies, and resources like the forex trading beginner guide Trading App APK.

What is Forex Trading?

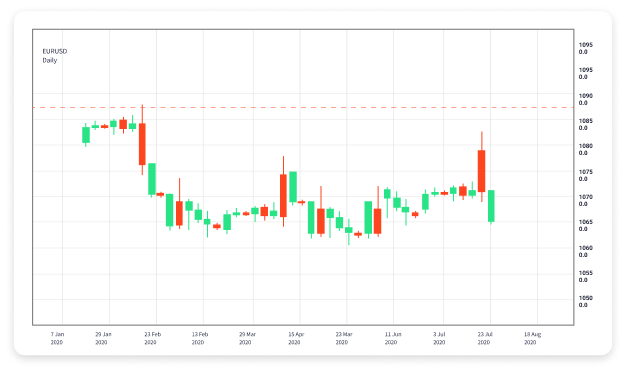

Forex trading involves buying and selling currency pairs. The goal is to leverage price fluctuations and make a profit. Each currency is represented by a three-letter code. For instance, the Euro is denoted as EUR, and the US Dollar is represented as USD. When trading, you are essentially betting on the strength of one currency against another.

Key Terms You Should Know

- Pip: The smallest price move in a currency pair, typically the fourth decimal place.

- Spread: The difference between the buying and selling price of a currency pair.

- Leverage: Using borrowed funds to increase potential returns, but it also increases risk.

- Lot: A unit that measures the size of a trade. A standard lot is 100,000 units of currency.

- Margin: The amount of capital required to open and maintain a leveraged position.

Understanding Currency Pairs

In forex trading, transactions occur in pairs—one currency is bought while the other is sold. Currency pairs are typically categorized into three types: major pairs, minor pairs, and exotic pairs. Major pairs involve the most traded currencies globally, such as EUR/USD and USD/JPY. Minor pairs include currencies that are less frequently traded, while exotic pairs consist of one major currency and one from a developing economy.

Choosing a Reliable Forex Broker

Selecting a trustworthy forex broker is crucial for beginners. Look for brokers that are regulated and provide a user-friendly trading platform. Ensure that they offer competitive spreads, low commissions, and a robust customer support system. Additionally, consider brokers that offer demo accounts, allowing you to practice trading without financial risk.

Developing Your Trading Strategy

Having a well-thought-out trading strategy is essential for long-term success. Begin by identifying your risk tolerance and defining your trading goals. Then, conduct thorough market research and analysis. There are two primary types of analysis:

Technical Analysis

This involves analyzing price charts and using indicators to forecast future price movements. Common tools for technical analysis include moving averages, relative strength index (RSI), and Fibonacci retracement levels.

Fundamental Analysis

Fundamental analysis involves evaluating economic indicators, geopolitical events, and news releases that may impact currency values. Pay attention to factors such as interest rates, inflation, and unemployment rates.

Risk Management Techniques

Proper risk management is critical in forex trading. Never risk more than a small percentage of your trading capital on a single trade. Use stop-loss orders to protect your investments and take-profit orders to lock in gains. Diversifying your trades can also help spread risk and minimize losses.

Common Mistakes to Avoid

- Overtrading: Trading too frequently can lead to excessive fees and increased risk.

- Ignoring the News: Economic news can significantly impact currency prices, so staying informed is crucial.

- Getting Emotional: Trading based on emotions can lead to poor decisions; stick to your strategy.

- Neglecting Education: Continuously educate yourself about forex trading strategies and market trends.

Resources for Beginners

Several resources are available to help beginners learning the ropes of forex trading. Consider the following:

- Online Courses: Many platforms offer comprehensive forex trading courses designed for beginners.

- Forex Trading Books: Explore recommended books that cover various aspects of forex trading.

- Webinars and Live Trading Sessions: Join webinars hosted by experienced traders to gain insights.

- Online Forums: Participate in discussions with other traders to learn from their experiences and strategies.

Conclusion

Forex trading offers immense opportunities, but it requires knowledge, discipline, and a sound strategy. As a beginner, take the time to educate yourself, practice trading on a demo account, and gradually implement your strategies in real markets. By following this comprehensive guide, you can build the foundations necessary for a successful forex trading journey. Welcome to the world of forex!