In the fast-paced world of forex trading, selecting the right broker is crucial for success. With numerous options available, traders must carefully evaluate their choices to ensure they partner with a reputable and reliable broker. This article will explore essential considerations when choosing a forex trading broker, including trading brokers forex https://tradingplatform-hk.com/, fees, regulations, and customer support. These factors will help you make an informed decision and enhance your trading experience.

Why Choosing the Right Forex Broker Matters

The forex market operates 24 hours a day, and its dynamic nature requires traders to be well-prepared. A reliable broker provides essential services that can significantly influence your trading performance. From executing trades to providing market analysis and support, the right broker can offer the necessary tools and resources for success.

Key Factors to Consider

1. Regulation and Licensing

One of the first things to check when evaluating a forex broker is their regulatory status. Regulation ensures that brokers adhere to strict standards aimed at protecting traders’ interests. Look for brokers regulated by well-known authorities, such as:

- The Financial Conduct Authority (FCA) in the UK

- The Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA) in the US

- The Australian Securities and Investments Commission (ASIC)

- The Cyprus Securities and Exchange Commission (CySEC)

A regulated broker offers a layer of security for your funds and should provide transparent information about their operations.

2. Trading Fees and Spreads

Trading fees can vary significantly among brokers and can have a substantial impact on your overall profitability. Here are the main types of fees to consider:

- Spreads: The difference between the bid and ask price, often expressed in pips. Look for competitive spreads, particularly on the currency pairs you plan to trade.

- Commission: Some brokers charge a commission per trade, while others may offer commission-free trading with wider spreads. Understand the cost structure before making a decision.

- Swap Fees: If you hold positions overnight, be aware of any swap (interest) fees that may apply.

Compare the fee structures of several brokers to find the one that aligns with your trading style and budget.

3. Trading Platforms

The trading platform is your primary interface for executing trades, analyzing markets, and managing your account. A robust and user-friendly platform can enhance your trading experience. Key features to consider include:

- User Interface: Look for platforms that are intuitive and easy to navigate, especially if you are just starting.

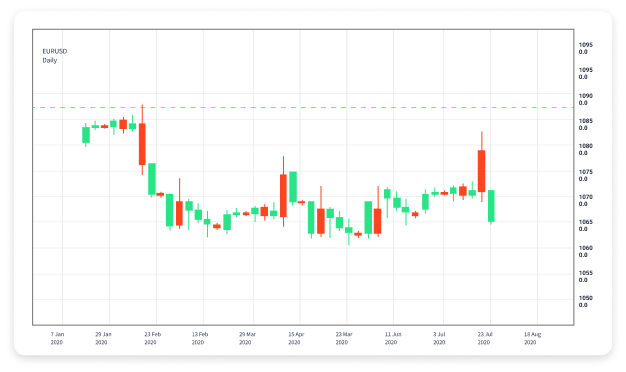

- Charting Tools: Advanced charting features and technical indicators are essential for effective analysis.

- Mobile Access: A mobile app allows you to trade on the go, making it convenient to manage your investments.

Popular trading platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Some brokers offer proprietary platforms, which you may want to explore.

4. Account Types and Minimum Deposit

Many brokers offer various account types tailored to different trading styles and experience levels. Consider the following:

- Standard Accounts: Typically meant for most retail traders, these accounts may require different minimum deposit amounts.

- ECN Accounts: Often suited for advanced traders, these accounts provide direct access to the interbank market.

- Demo Accounts: Ideal for beginners, demo accounts allow you to practice trading without risking real money.

Make sure to check the minimum deposit requirements and choose the account type that fits your financial situation.

5. Customer Support

Efficient and responsive customer support is essential, especially for traders who may need assistance quickly. Evaluate potential brokers based on the following criteria:

- Availability: Ensure customer support is available during trading hours and offers multiple contact options, including live chat, email, and phone support.

- Languages: If English is not your first language, ensure the support team can accommodate your language preferences.

- Response Time: Read reviews to gauge how responsive and helpful the customer service representatives are.

Research and Reviews

Before committing to a broker, undertake thorough research. Online reviews and trader testimonials can provide valuable insights into a broker’s reliability and overall service quality. However, rely on reputable review platforms to avoid biased or manipulated opinions.

Test the Broker

Many brokers offer demo accounts that allow you to explore their platforms and services without any financial risk. Use this opportunity to test the platform’s capabilities, assess the availability of educational resources, and evaluate overall user experience. Pay attention to execution speed, slippage, and the functionality of the trading tools.

Conclusion

Choosing the right forex trading broker can significantly affect your trading outcome. By considering factors such as regulation, fees, trading platforms, account types, and customer support, you can make an informed decision that aligns with your trading goals. Remember, it is crucial to conduct thorough research and test the broker before making any financial commitment. With the right broker by your side, you can take confident steps towards successful trading.